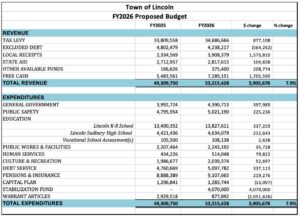

The Finance Committee is proposing a budget of $53.2 million for fiscal 2026, an increase of 7.9%. Residents will vote on the budget and other matters at Annual Town Meeting on March 29.

The Finance Committee is proposing a budget of $53.2 million for fiscal 2026, an increase of 7.9%. Residents will vote on the budget and other matters at Annual Town Meeting on March 29.

Property tax revenue is expected to rise from $33.80 million to $34.69 million, and local receipts (motor vehicle excise taxes, service and permit fees, etc.) are projected to go up by 67% ($2.33 million to $3.90 million).

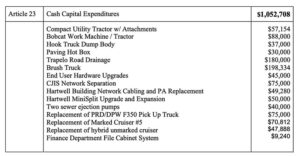

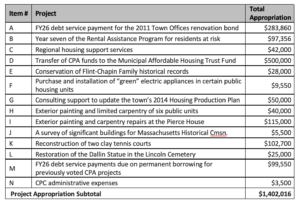

Expenditures will remain fairly stable, with one major exception: the FinCom plans to add $4.07 million to the stabilization fund, whereas it did not allocate anything for that purpose in fiscal 2025. This allocation will help restore much of the $4.75 million that was used last year to reduce the amount that will be borrowed for construction of the community center. Capital expenditures sought include $1.40 million for Community Preservation Act projects and $1.05 for Capital Committee requests (see tables below). Details on the proposed budget can be found beginning on page 1 of the PDF (browser page 8) of the Financial Report and Warrant.

The Finance Committee will host a virtual Q&A session on the proposed FY26 town budget on Tuesday, March 25 at 7:30pm (Zoom link here; meeting ID is 849 2072 7318, password is fincom). To keep Town Meeting as short and focused as possible, the committee hopes to address comments and questions in this virtual Q&A session before the in-person gathering. Click here to see a video of the February 25 budget presentation.

Click on the charts below to see larger versions.