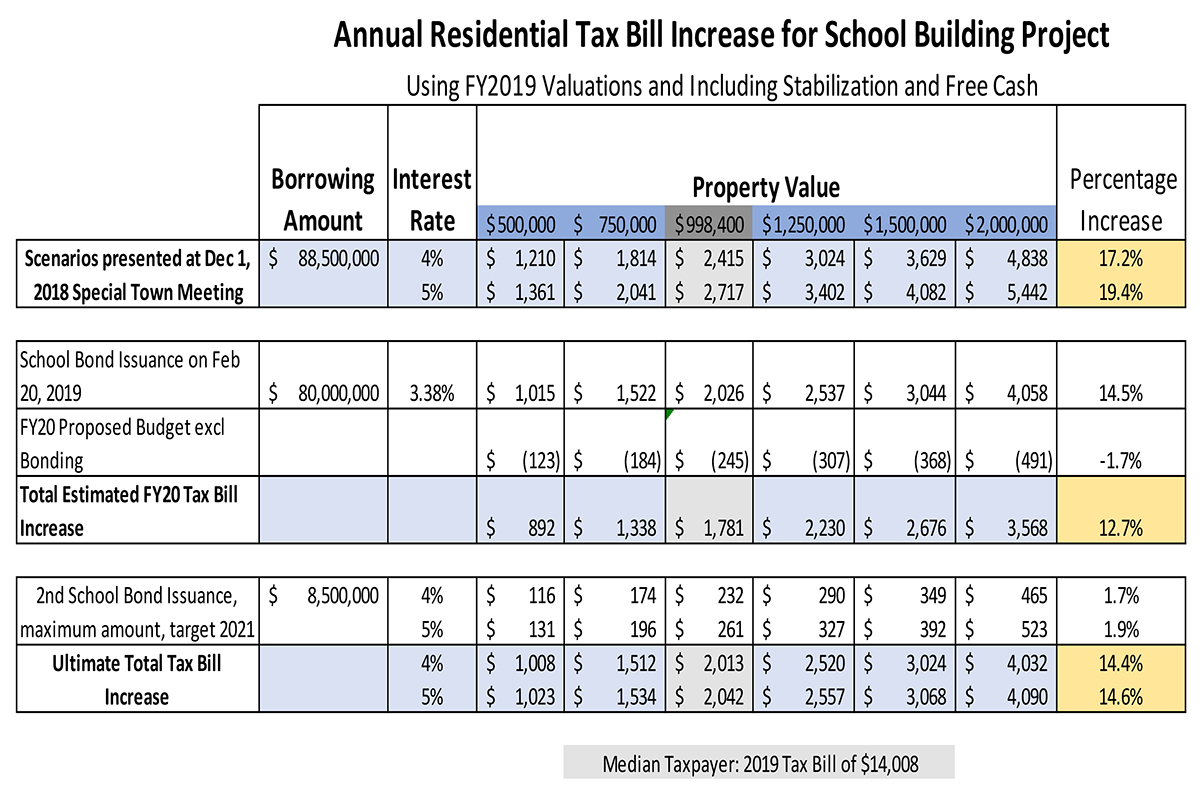

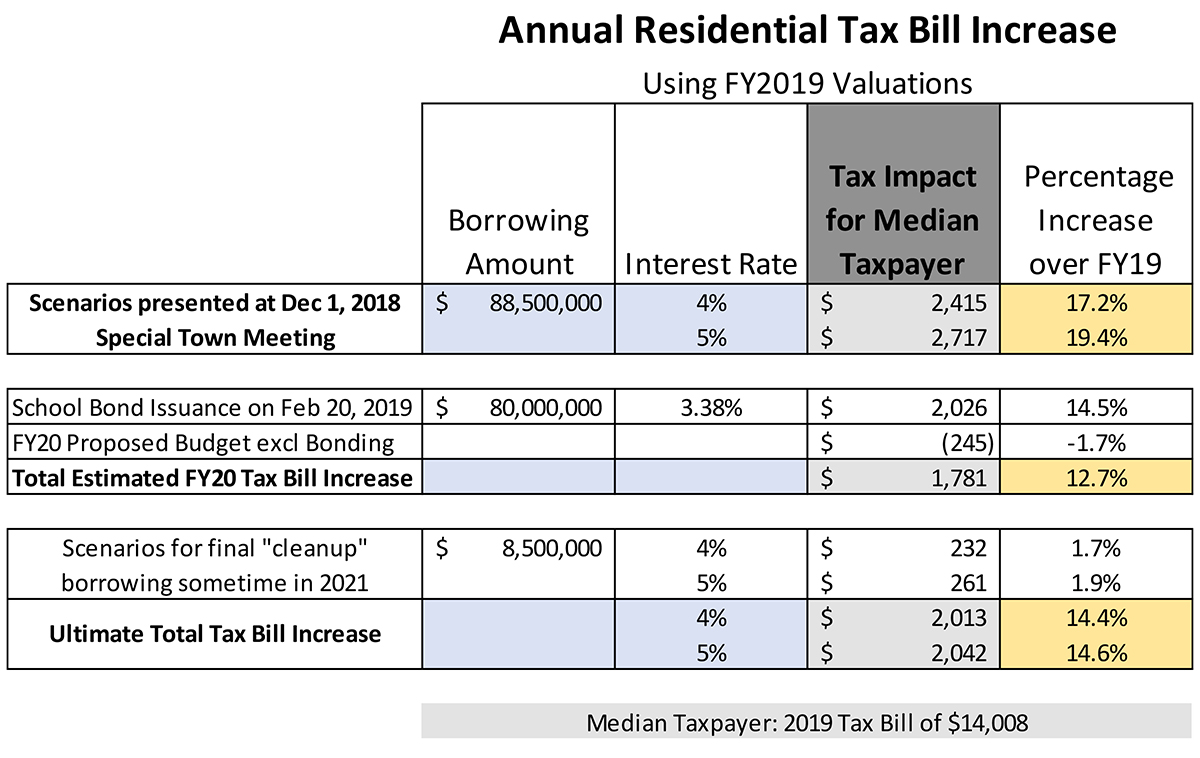

A table showing the tax increase for the median taxpayer with a tax bill of $14,008 in fiscal 2019, compared to earlier projections (click any image to enlarge).

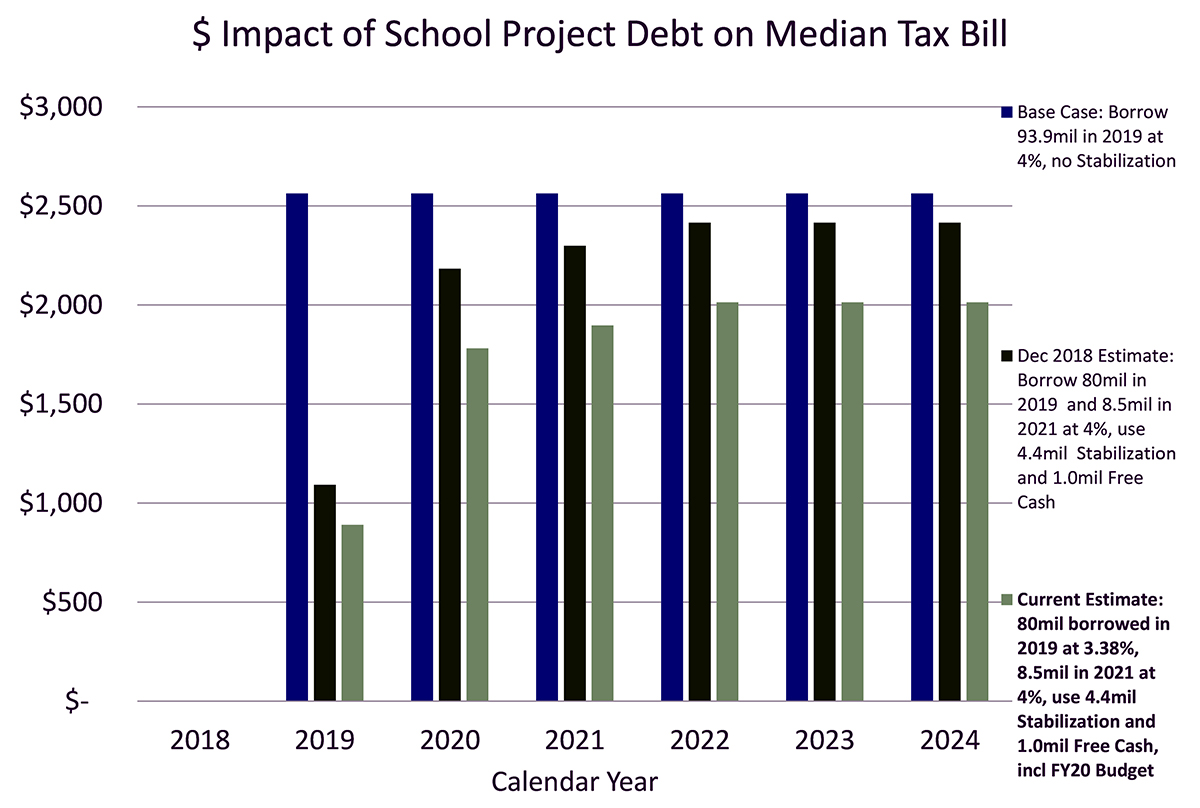

Once all the borrowing for the school project is done, Lincoln property owners will see a tax increase of 14.5% compared to fiscal 2019—significantly less than the 20% that some had feared.

As announced on February 26, winning bidder Citibank offered an interest rate of 3.379% on the $80 million bond. The Finance Committee had been using sample interest rates of 4% and 5% in projecting the tax increases from the $93.9 million school project. But as the town solicited bids on the bond, “we definitely benefited from the equity market volatility that happened in December,” FinCom chair Chair Jim Hutchinson said at Wednesday’s School Building Committee meeting.

From this $80 million bond alone, the median property tax bill would have increased by 14.5% next year. But the fiscal 2020 budget coming up for a vote at Town Meeting is “lean and mean” and, if there were no borrowing, would actually result in a 1.7% tax decrease, Hutchinson said. Taken together, the bond and the budget decrease will mean a $1,780 tax increase (12.7%) tax on the median tax bill.

In about two years, the town will do a “cleanup” bond of up to $8.5 million for the remaining expenses. That will mean another tax increase of about 1.8%, for a grand total increase of about $2,000 or 14.5% compared to the bill for fiscal 2019, Hutchinson said.