(Editor’s note: this post was updated on November 13 to correct errors in the tax increase range and the debt stabilization amount.)

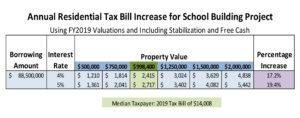

Lincoln residents will be asked if they approve borrowing $88.5 million for the school project, which will cost a total of $93.9 million. This will result in a property tax increase of somewhere between 17.2 percent and 19.4 percent, depending on the bond interest rate (assuming it is in the 4–5 percent range).

The Finance Committee unanimously recommended that the town pay for the project with an $88.5 million bond issue plus $1 million in free cash and $4.4 million from the debt stabilization fund. That fund currently stands at $5.5 million after voters approved adding $772,000 at the Annual Town Meeting earlier this year.

For a tax bill of $14,008 on a property valued at $998,400 (the 2019 median figures), the tax increase would translate to roughly $2,415–$2,717 (see table below). However, this full increase will not appear in the first year of repayment, because the Finance Committee may divide the borrowing into two or more separate bond issues or tranches. Thus, the $2,415–$2,717 increase would not be in year one but might take two to four years before it reaches that level of increase. Then this higher level would remain in effect for the life of the 30-year bonds.

On December 1 (Special Town Meeting) and December 3 (election), residents will be asked to approve the total bond amount of $88.5 million, but it will be up to the Finance Committee at a later date as to how the debt will be financed in terms of tranching.

After its vote on the funding recommendations, the Finance Committee released the following statement:

“On June 9th, the town decisively supported a school project that embodied educational values and sustainability through a renovated school project. We believe:

- The SBC has faithfully executed on this charge designing a project staying within the $93.9 million budget,

- The town can finance it and should be able to maintain our AAA bond rating,

and thus FinCom supports this project.”